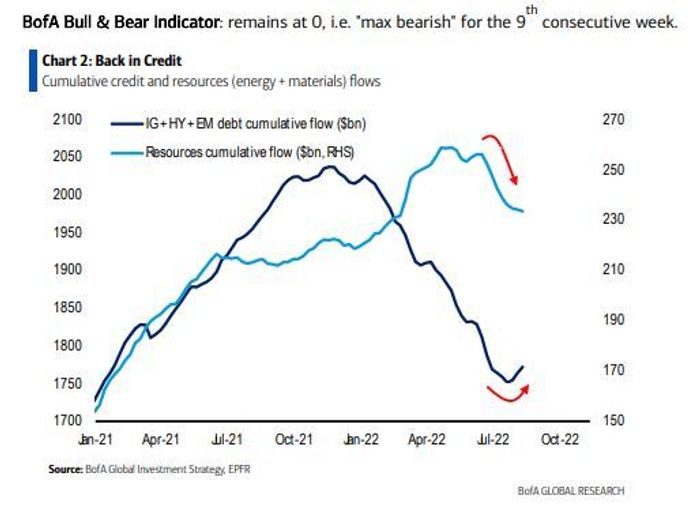

During a week where BlackRock Investment Institute analysts pitched investment-grade credit, Bank of America says bond funds — including investment grade, high yield and emerging-market — have seen their biggest sustained inflows since January as bond investors put money back to work.

In its weekly “flow show” report, Bank of America said that inflows were notable this week across stock, bond and certain commodity funds. Still, over the past two weeks, investment-grade credit funds have seen inflows of $7 billion, which is the best stretch since early this year.

On the government-bond side, nominal Treasury bond funds have seen steady inflows for months now, but inflation-protected government bonds have seen a five-week stretch of outflows.

Source: Bank of America

A look at individual equity sectors showed that resources and materials funds saw some of the largest outflows since January 2019.

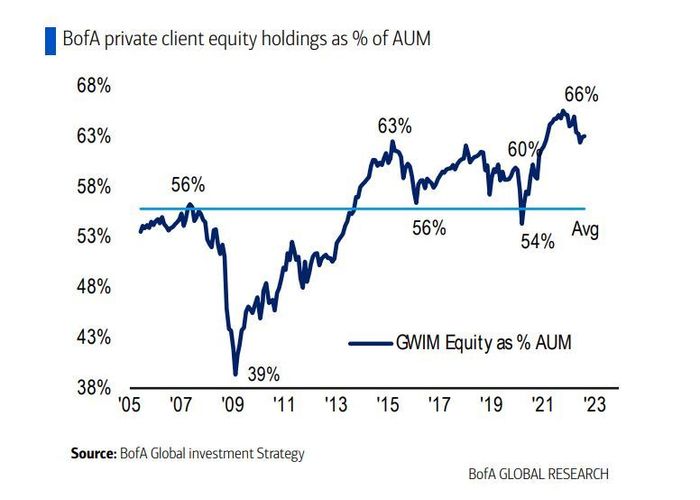

More broadly speaking, U.S. equities have seen sustained inflows all year long, even when prices were sliding earlier this year. Still, stocks saw their largest inflows in eight weeks last week.

Investors were particularly interested in financials and tech stocks, with tech seeing the largest inflows in eight weeks and financials seeing inflows for both of the past two weeks.

Source: Bank of America

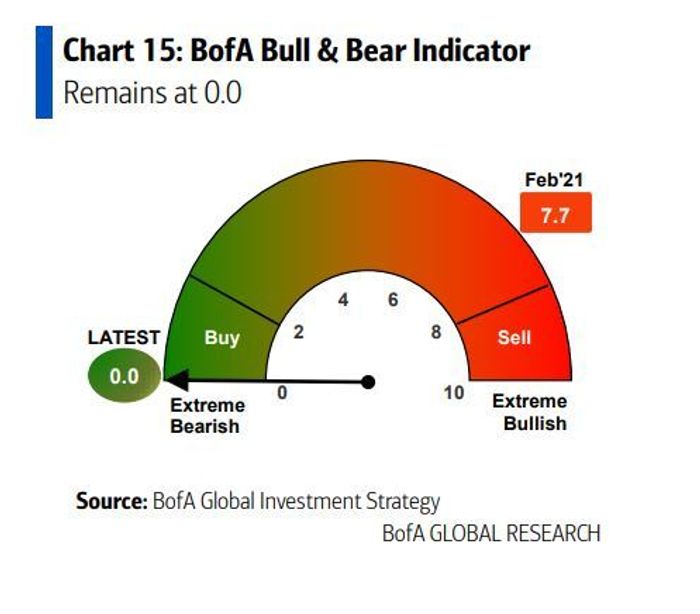

Finally, Bank of America’s weekly “bull and bear indicator” showed that the backdrop remained favorable for equity buyers, as sentiment remained mired in “max bearish” territory for a ninth straight week.

Source: Bank of America

Typically, when the gauge is at maximum bearish territory equities see positive returns over the following year.