““We’re not likely to see a recession this year.””

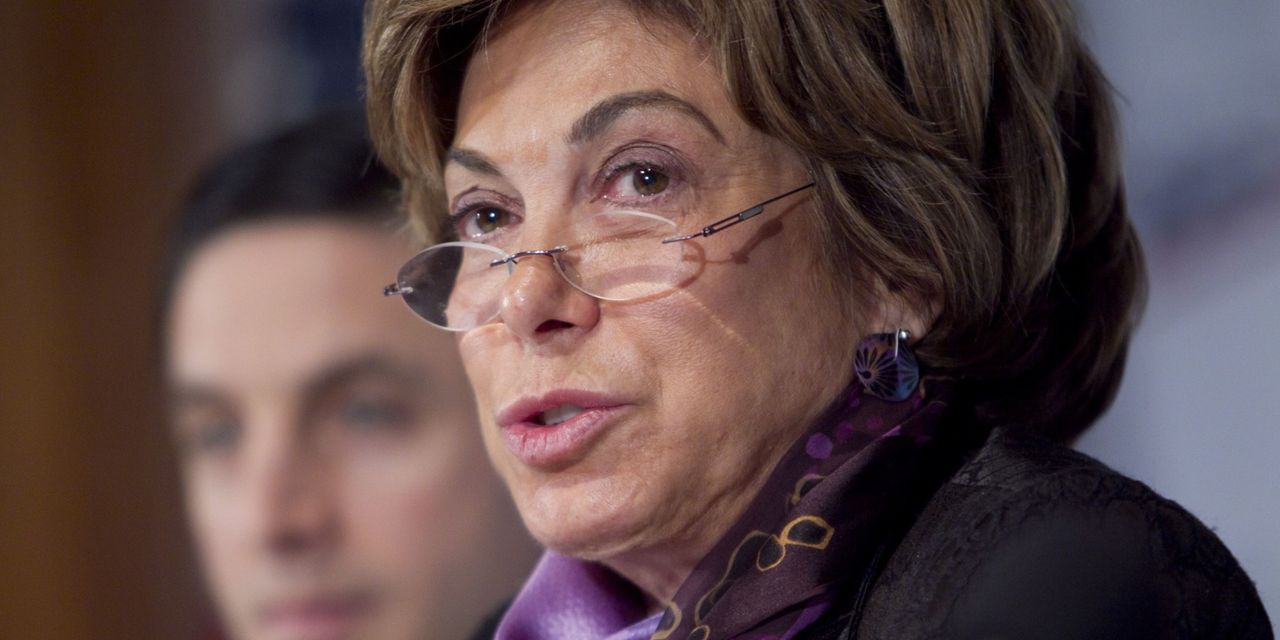

Worries about a recession, at least in the near term, have been ameliorated by the July consumer inflation and jobs data, said Laura Tyson, a former Clinton economic adviser and UC Berkeley Haas School of Business professor, on Wednesday.

“That [inflation] number, along with the very strong jobs number that came out, suggest that we’re not likely to see a recession this year,” Tyson said in an interview on Bloomberg Television.

The economic data also suggests that the Fed’s effort to achieve a soft landing — that is, bring down inflation without causing a recession — “may work,” Tyson added.

The likelihood of a recession depends, in part, on the Fed’s preferred time period for achieving its 2% inflation target.

In order to get a “neutral” policy rate, the Fed might have to raise its policy interest rate up to 5%, she said.

The Fed’s benchmark rate is currently in a range of 2.25%-2.5%.