The S&P 500 Index has rallied 10% since June 22 from a deep decline, but there are different schools of thought about whether investors are out of the woods yet.

Mark Hulbert has called the recent action a bear-market rally, setting the stage for the stock market to resume its slide. Meanwhile, analysts at BlackRock recommend investors lean toward defensive stocks.

One way to do that is to focus on the health-care sector. This is generally considered a defensive group of stocks — after all, the population is aging, innovation creates new treatments and medical attention is not an option for most people. A screen of health-care-sector stocks in the S&P 500

SPX,

is below.

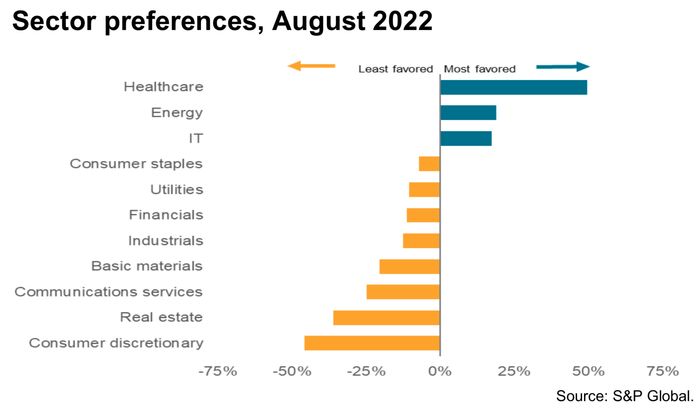

On Aug. 8, S&P Global Market Intelligence published results of a survey of money managers who oversee about $845 billion of investors’ money. This group of about 100 institutional investors remains “risk averse,” according to S&P Global, which went so far as to say that its Global Investment Manager Index indicated “overall sentiment” had it its lowest point in the survey’s history.

Here’s how the surveyed managers felt about the 11 stock sectors:

S&P Global

Health care is institutional investors’ favorite sector, and it is the fourth-best performer this year among the 11 sectors of the S&P 500. It also performed well during the bull market, ranking third for five years and 10 years through 2021:

| Total return – 2022 through Aug. 9 | Total return – 5 years through 2021 | Total return – 10 years through 2021 | |

| Energy | 38% | -7% | 13% |

| Utilities | 7% | 74% | 185% |

| Consumer Staples | -2% | 74% | 217% |

| Health Care | -6% | 125% | 389% |

| Industrials | -9% | 83% | 277% |

| Financials | -13% | 86% | 354% |

| Real Estate | -13% | 100% | 243% |

| Materials | -14% | 102% | 234% |

| Information Technology | -17% | 303% | 760% |

| Consumer Discretionary | -20% | 163% | 497% |

| Communication Services | -27% | 72% | 199% |

| Full S&P 500 | -13% | 133% | 363% |

| Source: FactSet | |||

According to the S&P Global survey report, the money managers have also been placing a greater emphasis on cash dividends as part of defensive allocation strategies.

Screening health-care dividend payers

One way to invest in the health-care sector is with an exchange traded fund for broad exposure, such as the Health Care Select Sector SPDR Fund

XLV,

which tracks the entire S&P 500 health-care sector, or with a more narrowly focused ETF, such as the iShares U.S. Healthcare Providers ETF

IHF,

If you wish for individual stock exposure in the health space and agree with the institutional investors’ preference for companies paying dividends, it might be helpful to see which companies are expected to generate enough free cash flow to support their dividends and increase them easily.

One way to do this is to look at free cash flow estimates for the next 12 months and divide those by current share prices for an estimated free cash flow yield. If the FCF yield is above the current dividend yield, a company appears to have “headroom” to increase the payout or use the extra generated free cash for other activities that might benefit shareholders, such as stock buybacks, expansion or acquisitions.

Among the 64 companies in the S&P 500 health-care sector, 40 pay dividends. Among those 40 companies, consensus free cash flow estimates among analysts polled by FactSet are available for 28. Here are the 10 health-care companies in the S&P 500 with the highest estimated free cash flow yields:

| Company | Ticker | Forward FCF yield | Dividend yield | Estimated FCF headroom |

| Viatris Inc. |

VTRS, |

21.63% | 4.59% | 17.04% |

| Bristol-Myers Squibb Co. |

BMY, |

10.76% | 2.88% | 7.88% |

| Pfizer Inc. |

PFE, |

9.94% | 3.21% | 6.73% |

| AbbVie Inc. |

ABBV, |

9.26% | 4.02% | 5.24% |

| HCA Healthcare Inc. |

HCA, |

7.84% | 1.07% | 6.77% |

| Laboratory Corp. of America Holdings |

LH, |

7.79% | 1.14% | 6.65% |

| AmerisourceBergen Corp. |

ABC, |

7.34% | 1.27% | 6.07% |

| McKesson Corp. |

MCK, |

6.99% | 0.61% | 6.39% |

| Quest Diagnostics Inc. |

DGX, |

6.97% | 1.90% | 5.07% |

| Merck & Co. Inc. |

MRK, |

6.16% | 3.08% | 3.08% |

| Source: FactSet | ||||

You should do your own research to form your own opinion about any individual stock you consider buying. One way to begin is by clicking on the tickers in the table for more information. Then read Tomi Kilgore’s detailed guide to the wealth of information for free on the MarketWatch quote page.

Don’t miss: These 18 tech stocks are this earnings season’s standouts based on three criteria