BlackRock, the world’s largest asset manager, likes investment-grade credit more than stocks as it sees “a new market regime with higher volatility taking shape,” according to a note Monday from strategists at the firm’s investment institute.

Investment-grade credit can “weather a significant growth slowdown whereas equities don’t look priced for this risk,” the strategists said in the note. “Yields look more attractive than at the start of the year,” they said, “making for improved valuations and a larger cushion against defaults.”

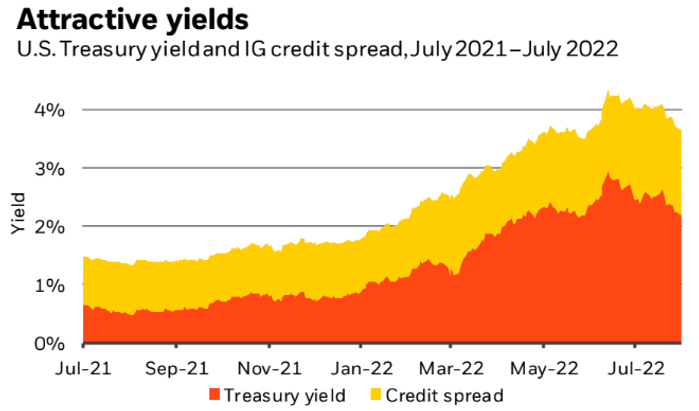

Treasury yields surged this year before declining from their June peak as investors began to price in lower rates amid slowing growth concerns. Investment-grade credit spreads, or their yield over comparable government debt, had similarly widened before narrowing in recent weeks, a chart in the BlackRock report shows.

BLACKROCK NOTE DATED AUGUST 8, 2022

“We still like IG credit at these levels,” the BlackRock strategists said. “Spreads have only marginally narrowed as investors lean back into equities.”

The drop in Treasury yields triggered an equities rally of more than 10% while investment-grade credit performance also benefited, according to their report. The yield on the 10-year Treasury note

TMUBMUSD10Y,

fell 7.5 basis points Monday to 2.763%, compared to as high as 3.482% on June 14, according to Dow Jones Market Data.

“Equity valuations, meanwhile, don’t reflect the chance of a significant slowdown yet, so earnings estimates are still optimistic,” the strategists wrote.

U.S. stocks closed mixed Monday, with the S&P 500

SPX,

falling 0.1% to around 4,140, according to preliminary FactSet data. The blue-chip Dow Jones Industrial Average

DJIA,

rose 0.1% while the technology-laden Nasdaq Composite

COMP,

slipped 0.1%.

‘Good shape’

Investment-grade borrowers are in “good shape,” according to the BlackRock strategists. “We think credit quality is still solid,” they wrote.

The refinancing needs of investment-grade companies don’t appear “pressing” after their surge in bond issuance last year, the strategists said, noting that supply of new bonds this year is “relatively low.”

As for high-yield debt, or junk bonds, the strategists said “parts of high yield offer attractive income, but concern over widening spreads in any slowdown steers us toward” investment grade.

Investors are awaiting Wednesday’s consumer-price-index report for a gauge on U.S. inflation in July, which will inform their views on whether the Federal Reserve will keep up its aggressive interest-rate hikes to battle the surging cost of living. Market participants have worried that the U.S. central bank risks causing a recession by raising rates too much too fast as it seeks to cool the economy.

“Markets currently appear to expect that a mild contraction will result in falling rates and lower inflation,” wrote the strategists. BlackRock expects that a “soft landing” is unlikely “in a volatile macro regime shaped by production constraints,” according to their note.

“Central banks will have to plunge the economy into a deep recession if they really want to squash today’s inflation — or live with more inflation,” the strategists said, “but they are not ready to pivot yet.”

Against a backdrop of lower growth and elevated inflation, “we see bond yields going up and equities at risk of swooning again,” they wrote. On a tactical horizon, which BlackRock defines as 6 to 12 months, the strategists are “overweight” investment-grade credit versus equities, the report shows.

“This is a move up in quality in a whole portfolio approach after we reduced risk throughout this year in response to higher macro volatility,” they said. The strategists’ “signpost” for turning positive on equities again will be “a dovish pivot by central banks when faced with a big growth slowdown, a definite sign they will live with inflation.”