Stifel chief equity strategist Barry Bannister has lifted his target for the S&P 500 index by 200 points to 4,400 for the second half of 2022, expecting “cyclical growth” stocks to lead the way higher in a “relief rally.”

“We continue to prefer cyclical growth,” Bannister said in a note dated Aug. 4, pointing to the software, media, tech hardware, retail and semiconductor industries. “The five cyclical growth industry groups we see rallying are dominated by large technology-related stocks.”

The S&P 500

SPX,

which tracks U.S. large-cap stocks, was trading down early afternoon Friday at around 4,132, FactSet data show, at last check. Stifel’s revised target implies that the index could gain more than 6% by yearend.

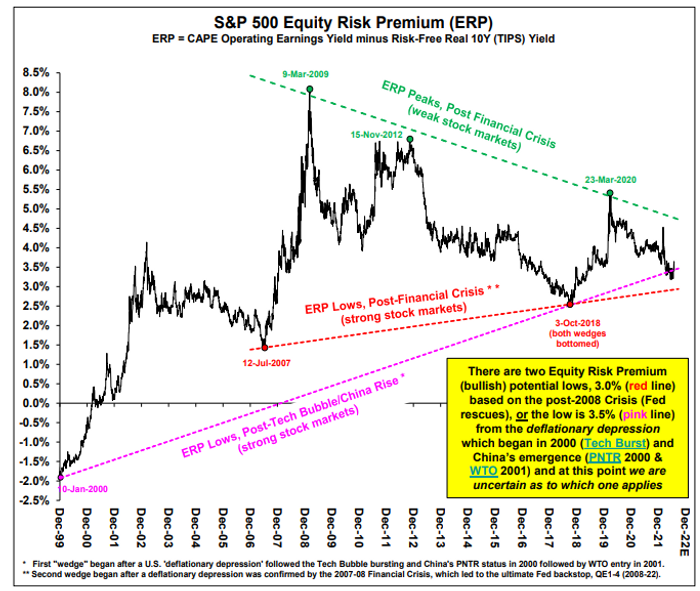

Bannister raised his price target for the U.S. stock-market benchmark as bets on 36-month Fed funds futures appear to have peaked and the “equity risk premium” for the S&P 500 now indicates 4,400 as a mid-point price target, according to the note.

“Fed futures are tapped out,” he wrote.

The Federal Reserve has been aggressively hiking its benchmark interest rate in an effort to tame the highest inflation in decades. Investors have been trying to assess whether inflation, and in turn, Fed hawkishness have peaked.

“Inflation is likely to sharply decline soon in a (highly unusual, COVID policy-shaped) non-recession slowdown,” Bannister wrote in his note. He expects “cyclical growth” stocks will see “a strong relief rally as inflation slows, Fed expectations are pulled back, and the economy has the balance sheet and momentum in 2022 to mitigate recession risk.”

In late June, Bannister predicted that “cyclical growth” would lead a 10% “relief rally” for the S&P 500 this summer. The U.S. stock market surged last month, with the S&P 500 and Dow Jones Industrial Average each booking their biggest monthly gains since November 2020 while the tech-heavy Nasdaq Composite scored its best July ever.

The S&P 500 is up around 9% so far in the third quarter, FactSet data show, at last check. That’s after the benchmark tumbled 20.6% in the first half of 2022, sinking as investors fretted over rising interest rates hurting the valuation of stocks.

The stock-market selloff seen in the first half of 2022 is “still being reversed,” said Bannister. He said the rally “requires” U.S. financial conditions “not to tighten,” while oil shocks from the Russia-Ukraine war are also a risk to his new S&P 500 target.

But in his view, the potential peaking of 36-month Fed rate futures puts in a top for the real yield of 10-year Treasury Inflation-Protected Securities, “which is usually bullish” for the S&P 500’s price-to-earnings ratio. The so-called equity risk premium, which is the earnings yield minus the 10-year TIPS real yield, may drop to 3% to 3.5%, which is bullish for the index, according to his note.

STIFEL REPORT DATED AUG. 4 2022

U.S. stocks were trading lower Friday after a stronger-than-expected July jobs report stoked worries that the Fed may need to stay aggressive in raising its benchmark interest rate in order to bring down inflation. The Dow Jones Industrial Average

DJIA,

was down 0.1% while the S&P 500 was off 0.5% and the Nasdaq Composite

COMP,

dropped 0.8%, FactSet data show, at last check.

For the week, the Nasdaq was heading for a 1.8% gain, while the S&P 500 was roughly flat and the Dow was on pace to decline 0.5%.