It can be tempting to chase performance during any given year, but unfortunately it’s a tried-and-true way to lower your investment returns in the long run.

Jonathan Good, manager of the Baird Small/Mid Cap Growth Fund

BSGIX

BSGSX,

described in an interview why it’s important to stand firm in bear markets.

His stock-selection strategy has led to the fund being rated five stars (the highest) by Morningstar. It has a competitive record for its life of nearly four years.

Good said the fund’s long-term success has sprung from a focus on five factors, from bottom-up analysis of companies with market capitalizations averaging $10 billion:

- Profitability.

- Revenue growth.

- Industry dynamics.

- Management teams.

- Expectations. This is what Good called “the hardest part,” an attempt to understand what is embedded in consensus estimates for financial performance, and whether those expectations are too low or too high.

Below are four examples of stocks held by the Baird Small/Mid Cap Growth Fund, along with Good’s comments and growth estimates for earnings and sales that tie into the five factors above.

Outperformance in a difficult year

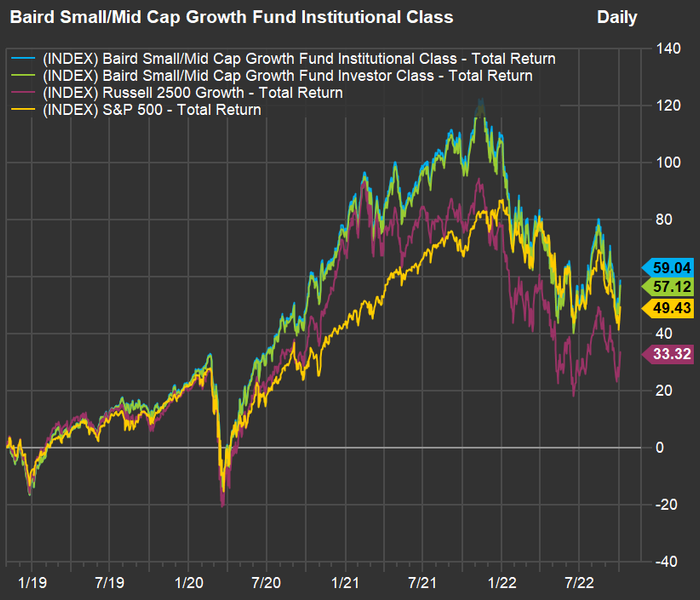

Let’s look at the performance of the Baird Small/Mid Cap Growth Fund’s two share classes against its benchmark, the Russell 2500 Growth Index

XX:R25IG,

as well as the S&P 500, since the fund’s inception on Oct. 31, 2018:

FactSet

That’s an impressive record — beating the two broad indexes, especially for a fund that is not very concentrated. The Baird Small/Mid Cap Growth Fund tends to hold between 60 and 70 stocks of companies with market capitalizations ranging from $500 million to $12 billion.

“I t might seem strange to say when the fund is down 24% that I am OK with our risk-reward over the next 12 months. ”

What may surprise you even more about the fund’s performance is that both of its share classes are down 24% this year. The Russell 2500 Growth Index is down 25% and the S&P 500 is down 20% (all with reinvested dividends).

How to view the risk-reward ratio

When discussing the bear market of 2022, Good said that looking back, he believed that the companies in the Baird Small/Mid Growth portfolio would fare well in a rising-interest-rate environment “because of strong balance sheets,” but “the headwind was the multiples [price-to-earning ratios] were high.”

“It might seem strange to say when the fund is down 24% that I am OK with our risk-reward over the next 12 months,” Good said.

Jonathan Good, manager of the Baird Small/Mid Growth Fund.

Baird Asset Management

He said this year’s decline for the fund reflected his strategy “not to take big sector bets.” (Some funds hit the jackpot this year, with outperformance based entirely on heavy allocation to energy stocks.)

Good called the fund’s excellent long-term record “a function of good bottom-up stock picking and having good, quality businesses that have outperformed.” Those include dynamic innovators as well as “long-term compounders with consistent and revenue growth, which fed multiple expansion.”

Four stocks held by the fund

Good — who specializes in covering health care industries and has a degree in applied and biomedical sciences from the University of Pennsylvania and an M.B.A. from the Kellogg School of Management at Northwestern University — said the Baird Small/Mid Growth Fund is overweight health care and industrials when compared with its benchmark, the Russell 2500 Growth Index.

But he also said the index itself is about 90% weighted to four sectors: health care, technology, industrials and consumer discretionary.

He said that the SMID space offers particular flexibility to him as a fund manager, as he can focus mainly on profitable companies with an average market capitalization of about $10 billion, but can also capture smaller companies that appear to have strong paths for sales growth, even if they have not yet achieved profitability.

Here are four companies he discussed:

Five Below Inc.

FIVE

may already be familiar to you as a consumer. Good sees “a big runway of unit growth” for the discount retailer, and said “they are even rolling out a 10-below option, with more flexibility.” He pointed to the company’s advantage during a period of high inflation and its ability to roll with consumer fads. Analysts polled by FactSet expect the company’s sales to increase at a compound annual growth rate (CAGR) of 18.8% over the next two calendar years through 2024, with earnings per share increasing at a CAGR of 24.6%.

ShockWave Medical Inc.

SWAV

is “an incredibly rapid growth story,” Good said. The company makes equipment and develops procedures for the removal of calcium from the circulatory system, using sound-wave technology similar to that used to remove kidney stones. Good said the technology is easy for doctors to learn and has “good reimbursement” from insurance companies. Analysts expect to see a two-year sales CAGR of 27.2% through calendar 2023, with an EPS CAGR of 34%.

Repligen Corp.

RGEN

develops processing technologies and modular supply products for use in the manufacture of biological medications. “They have driven growth with the idea of single-use and consumable, rather than the old version of stopping, cleaning, supplying, etc.” New, modular approaches may help many biotech companies lower their risk and their costs. Good also said that Repligen has been “making incredibly smart acquisitions. Now, “a big source of debate” over the stock is “what happens when Covid goes away,” he said. Based on estimates of analysts polled by FactSet, the consensus calls for Repligen to achieve a two-year sales CAGR of 15.9%, with an EPS CAGR of 17.6% through 2024.

Paycor HCM Inc.

PYCR

provides a suite of human-resources software services for small and medium-size companies. “This is a case of a very large market opportunity for small business,” Good said, although he added that Paycor is also “moving upmarket.” The consensus estimates call for a two-year sales CAGR of 18.3% for Paycor, with an EPS CAGR of 31.5%.

For context, consensus estimates point to sales CAGR of 4.5% through 2024 for the S&P 400 Mid Cap Index

MID

and EPS CAGR of 6.4% for that index.

Don’t miss: Dividend yields on preferred stocks have soared. This is how to pick the best ones for your portfolio.