U.S. stock futures on Tuesday edged back from its best levels in a month, as a slate of key earnings were set to hit.

What’s happening

-

Futures on the Dow Jones Industrial Average

YM00

fell 92 points, or 0.3%, to 31453. -

Futures on the S&P 500

ES00

dropped 8.75 points, or 0.2%, to 3801. -

Futures on the Nasdaq 100

NQ00

decreased 8.5 points, or 0.1%, to 11470.

On Monday, the Dow Jones Industrial Average

DJIA

rose 417 points, or 1.3%, to 31500, the S&P 500

SPX

increased 45 points, or 1.2%, to 3797 and the Nasdaq Composite

COMP

gained 93 points, or 0.9%, to 10953.

What’s driving markets

The S&P 500 has climbed four of the last six trading days and ended Monday at its highest level since Sept. 20.

“The market loves symmetry and that huge selloff from the September highs will result in an equal impressive rebound,” said Jani Ziedins of the Cracket Market blog. “Sure, maybe lower prices are ahead of us over the longer term, but never forget the biggest and fastest rallies occur during bear markets, and the last time I checked, this was still a bear market.”

A wave of corporate earnings are on tap, including from Coca-Cola

KO,

General Electric

GE,

and after the close, Google parent Alphabet

GOOGL

and Microsoft

MSFT.

The economics calendar includes the Conference Board’s measure of consumer confidence, shortly after the market open.

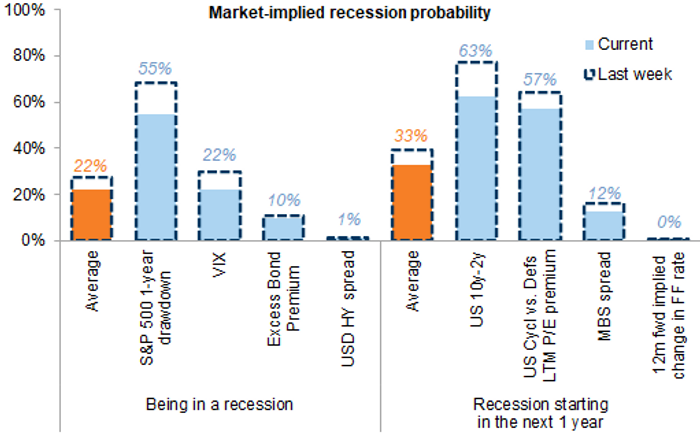

Strategists at Goldman Sachs noted a steepening yield curve, particularly for inflation-protected securities.

Goldman Sachs

“Our market implied U.S. recession probability model also suggests investors are willing to fade recession risk over the next year, possibly helped by a better-than-expected U.S. earnings season so far. The curve steepening and a re-pricing of cyclicals vs. defensives has driven the implied probability lower to levels roughly in line with the 35% recession odds from our economists,” they said.