There’s a 35% chance the U.S. enters a recession by the end of next year given the tightening the Federal Reserve is embarking on, according to a new research paper from the central bank.

The paper — authored by five economists, including Andrea Ajello, chief of the macro financial analysis section of the Fed’s monetary affairs division — studies the inverted yield curve, which is the market’s way of predicting recessions. They created a model, using data going back to the early 1960s, to predict the probability of a recession.

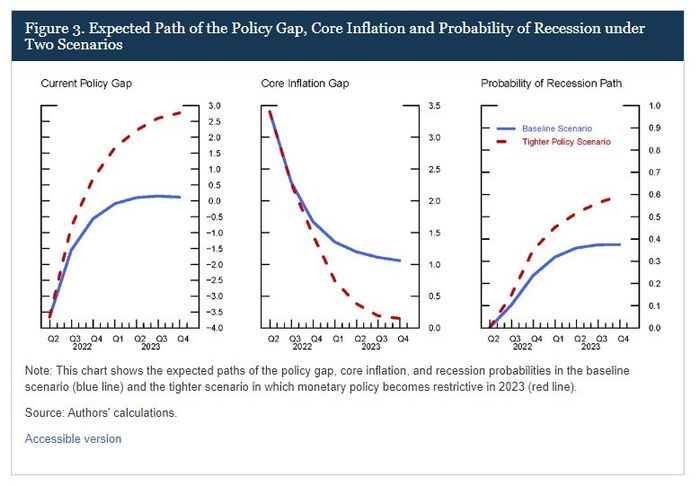

The good news is that they don’t see a recession as imminent. “Using data through early June 2022, we estimate a largely accommodative current policy gap that lowers the odds of an incipient economic downturn. We also find a downward sloping expected inflation curve. Historically a decrease in the slope of the expected inflation curve is associated with a higher likelihood of a recession,” they say.

But that changes as they anticipate the Fed moving to a “mildly restrictve” policy. From there, the probability of a recession moves to about 25% by the end of the year and to 35% by the end of 2023. They say that’s comparable to the levels estimated ahead of the 1994 monetary policy tightening that resulted in a soft landing. Their model assumes yields rising to 2.5% in 2022 and to 2.8% next year, which is a bit less aggressive than the official Fed forecast.

They also modeled a “tighter-policy” scenario, in which case inflation moves down more rapidly and recession chances increase, to 35% by the end of 2022 and to 60% by the end of 2023. That tighter policy peaks at 5.1% in 2023, a good deal more restrictive than the official Fed forecast.

Policymakers are not bound by the views of Fed staff, but such a paper is likely to color their discussions. Many strategists say the 20% decline in the S&P 500

SPX,

this year implies a mild recession.