It all comes back to bonds.

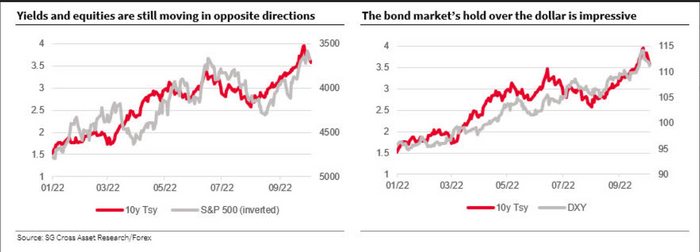

A closely watched U.S. dollar index fell sharply Tuesday, accelerating a retreat from a 20-year high and giving stocks and commodities room to bounce. But the tune in the FX market, as well as other assets, remains largely a function of the bond market, reminded Kit Juckes, global macro strategist at Société Générale, in a Tuesday note (see chart below).

Société Générale

Treasury yields, which had accelerated a surge higher in the wake of the Federal Reserve’s Sept. 20-21 meeting, were in retreat as investors weighed the prospect of a so-called pivot by policy makers away from its path of rapid and aggressive rate increases.

“This is not the first time a pattern of rising U.S. bond yields and falling equity indices was interrupted by a correction in the former. U.S. 10-year Treasury note yields had sizable corrections in May and again in June/July, both of which triggered bear market rallies in the equity market,” Juckes wrote.

The following August-September rise in the 10-year Treasury yield

TMUBMUSD10Y,

which went from 2.6% to almost 4%, gave the ICE U.S. Dollar Index

DXY,

an almost 10% lift and took the S&P 500 down by more than 10%, with major indexes ending last month at their lowest levels since 2020, he noted.

The Treasury selloff is taking a breather, with yields retreating sharply across the curve. The 10-year yield, which briefly ticked above 4% late last week, was trading near 3.623%. The ICE U.S. Dollar Index, which tracks the currency against a basket of six major rivals, dropped 1.3% on Tuesday, leaving it down 1.6% over the last two days after hitting a more-than-20-year high last week. The pullback has seen the index erase the sharp gain it posted in the wake of the Fed’s Sept. 21 rate hike.

Stocks were bouncing sharply to begin October and the fourth quarter, with the Dow Jones Industrial Average

DJIA,

S&P 500

SPX,

and the Nasdaq Composite

COMP,

each up more than 5% over the last two sessions.

A strong dollar was seen as a headwind for stocks, particularly large-cap multinationals who rely more on overseas sales. The dollar’s strength was also blamed for helping send crude futures to eight-month lows in September and sinking gold. A stronger dollar is seen as a weight on commodities priced in the unit, making them more expensive to users of other currencies.

The U.S. crude benchmark

CL.1,

has jumped more than 8% this week on expectations OPEC+ will deliver a large production cut and as the dollar has pulled back. Gold futures

GC00,

have bounced 3.7%.

The dollar, of course, was seen as heavily stretched versus major rivals. The British pound

GBPUSD,

plunged to an all-time low versus the U.S. dollar late last month as the U.K. government’s budget plans sparked a fiscal crisis that forced the Bank of England to begin buying U.K. government bonds to stave off a collapse of pension funds.

The euro

EURUSD,

has bounced 1.8% versus the dollar this week but remains down more than 12% so far this year and continues to trade below parity with the U.S. dollar. The Japanese yen

USDJPY,

last month traded at its weakest to the dollar since 1998, eventually prompting a rare bout of currency market intervention by Japanese authorities.

The dollar’s retracement is due to factors that are likely to fade, said Bipan Rai, head of FX strategy at CIBC Capital Markets.

“First is profit taking in tactical longs that have been built over the past few weeks. Second is the ‘peak rates’ narrative which has been given some life due to the softer ISM, [job openings data] and shift lower of late in breakevens/inflation swaps,” Rai told MarketWatch, in an email.

Indeed, analysts have cited expectations the Fed may be getting closer to the end of its rate-hike cycle as signs of cracks emerge in global financial markets and U.S. data begins to soften as a factor behind the rally in stocks and bonds (bond yields move opposite to price).

Rai was skeptical the dollar’s retreat would hold.

“We suspect the market will go back to fading this – as the data points that do matter (employment + core CPI) still indicate that the Fed has work to do. The uncertainty with where the resting spot for terminal is for the Fed will keep the USD supported on dips,” Rai said. The terminal rate refers to where the fed funds rate will peak.

Meanwhile, the Reserve Bank of Australia on Tuesday stoked “pivot” expectations as it delivered a smaller-than-expected rate increase and said future moves would depend on data.

“Is the Fed going to follow the RBA and pivot to a slower pace of policy tightening, shifting the dollar smile down in the process and triggering a deeper wave of short covering for other currencies?” Juckes asked. The “dollar smile” refers to the tendency of the U.S. currency to rally when the U.S. economy significantly outperforms or underperforms its peers.

Read: What does a pivot look like? Here’s how Australia’s central bank framed a dovish surprise.

Stocks extended gains Tuesday, while Treasury yields and the dollar retreated further after a soft job openings and labor turnover survey, or JOLTS, reading pointed to a modest loosening of a tight labor market. Juckes, writing ahead of the JOLTS report, said this week’s data, including Friday’s September jobs report, will likely set the tone for coming weeks. But he was skeptical Treasury prices have much room to continue their bounce (yields move opposite to price).

“My bias is to think that this bond market rally has gone about as far as it can, and when yields turn higher again, equities will struggle, and the dollar will get its mojo back,” Juckes said. “At which point, the FX market, having exhausted itself trading sterling in recent weeks, may revert to selling the euro.”

—Joseph Adinolfi contributed to this article.