The storming start to the week for U.S. equities may have felt impressive, but it was a technical failure that bodes ill for short-term stock market bulls.

That’s according to Jonathan Krinsky, chief market technician at BTIG, who maintains that history suggests such action means the rally should be faded.

The problems relates to what chartists call an “inside day,” when in a two-day period the second session has a range that is completely inside the first one.

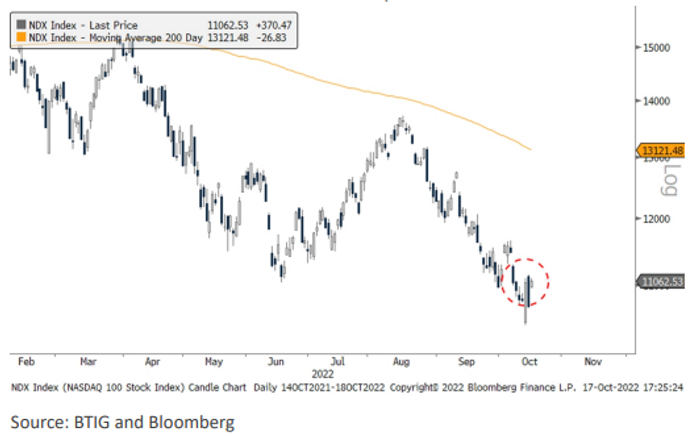

Taking the Nasdaq 100

NDX,

Krinsky notes that the tech barometer’s 3.4% rally on Monday operated within last Friday’s top to bottom range of around 4%.

That qualifies as an inside day, he says, and a 3% one is quite rare, having occurred just 9 other times when the index has been below its 200-daily moving average.

An inside day below the 200-day moving avaerage.

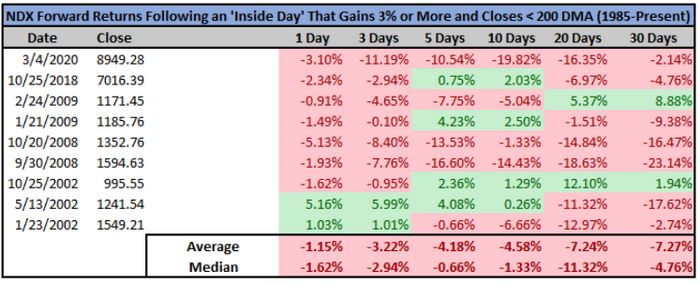

“While stats, particularly those with small sample sizes, should never be used in isolation, we think the recent action is telling and has tended to occur in the midst of bear markets more than the start of new bulls,” he writes in his latest note to clients.

The average and median returns for the Nasdaq 100 over the next 20 days has been -7.23% and -11.32%, respectively, according to Krinsky’s calculations, shown in the table below.

Source: BTIG

“You can see…the forward returns following such days like today are quite ugly. The best outcome was October 2002, which did occur after the final bear market bottom, but was after two and a half years of a bear market and an 80% decline. February ’09 was within a couple weeks of the final bottom, but also came after a ~18 -month -50% bear market. The current set -up is not the same, in our view,” says Krinsky.

“We don’t think we are at the final end of this bear market, and therefore would be inclined to fade this rally,” he concludes.