This recent market turmoil was brought to you by the letter “P”. Prices that are rampant. U.K. Pension funds that are creaking. All investors want is to be shown the possible path to a pivot please.

Can Thursday’s consumer inflation numbers help? On their own they won’t cause the Federal Reserve to reverse course in its monetary policy tightening. But, if softer than expected, the CPI report may indicate borrowing costs are at least nearing their peak.

If not, then sentiment toward the banking sector, which kicks off the earnings season on Friday, will remain depressed say analysts at Bank of America led by Ebrahim H. Poonawala.

The S&P 500 Banks Industry Group Index

SP625,

is down 29.7% for the year to date, worse than the broader market’s 25% drop. The derating has been driven by “perceived risks” tied to the economic outlook even though fundamentals — robust lending, improving net interest margins — have remained strong, according to Poonawala.

“We expect the damage caused by runaway inflation (and reactionary monetary policy) to weigh on the fundamental growth outlook. This means slowing loan growth, rising credit costs and an eventual peak in net interest margins. These have the potential to drive another leg lower in the group,” he adds.

With that in mind, here’s what BofA thinks of the big banking beasts due to report in the next few sessions. And despite repeated criticism in Congress over its many scandals, Wells Fargo

WFC,

may be the best positioned bank. Wells Fargo is relatively immune from the fading Wall Street activity, in equity trading and investment banking in particular, that may drag rivals. “But [Wall] Street will need validation that share buybacks will resume after management surprised investors with no share buybacks in 3Q22,” and that management has a focus on expense savings into 2023.

JPMorgan Chase

JPM,

results due Friday. “A de-rated stock valuation, well understood capital challenge, visibility on 2023 expenses have all created an openness among certain investors to add exposure. While the stock has a history of trading poorly on earnings print, the stock weakness coming into Friday’s results could lead to outperformance, provided we don’t get any idiosyncratic negative surprises.”

Citigroup

C,

(Friday). The stock appears oversold at just 0.5 times price to book value, says Poonawala. “However, the lack of investor appetite to add exposure to a restructuring story that lacks both capital/expense leverage and where near term EPS visibility is very limited is essentially non-existent.” While the low expectations could lead to a bounce in the stock if forecasts are met, short interest in Citi has already declined by 29% since the end of June, he notes.

Morgan Stanley

MS,

(Friday). “Remains among the most favored names in our coverage universe. Strong execution combined with deal driven synergies and idiosyncratic growth drivers that allow management to show continued progress towards its strategic goals should keep shareholders satisfied,” says Poonawala. Still, the banks’ above average exposure to equities trading and the investment banking downturn could drag.

Goldman Sachs

GS,

(Tuesday). “[The] ability to defend the return on equity in light of continued weakness in investment banking activity is key to supporting our thesis… for a secular re-rating in the stock. Investors will be keenly watching for management comments on the consumer strategy given the flurry of news reports in recent months suggesting that a strategic rethink is underway.”

(Bank of America, which he obviously doesn’t cover, reports results on Monday.)

So, mixed expectations. And Poonawala concludes that though it’s currently unlikely, a Fed pivot would be viewed positively for the banks, just like it did when the central bank shifted in 1994/95.

However, he warns: “While a Fed pivot could lead to a short term bounce, investors would need to gain better visibility on the macro-economic outlook in order to shed the late cycle mindset.”

Markets

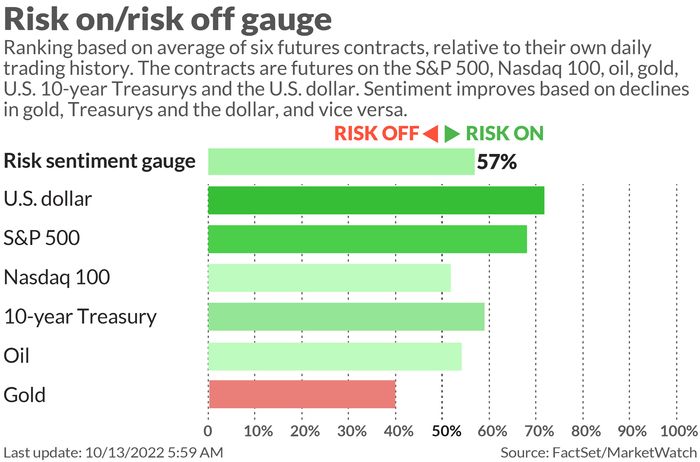

Stock futures were calm as traders waited for inflation data, with the S&P 500

ES00,

contract up just 0.3% to 3,599. The dollar index

DXY,

was off 0.3% to 113.01 and the 10-year Treasury yield

TMUBMUSD10Y,

rose less than 1 basis point to 3.907. Gold

GC00,

gained 0.2% to $1,681 an ounce and Bitcoin

BTCUSD,

fell 0.8% to $19,001.

The buzz

Here are the forecasts for those September CPI numbers, due at 8:30 a.m. Economists reckon headline month-on-month CPI will rise 0.3% and core CPI will be up 0.4%. Over the year the headline is believed to have fallen from 8.3% in August to 8.1% but the core to have risen from 6.3% to 6.5%. Weekly initial jobless claims will be published at the same time.

U.K. government bonds were in focus ahead of Friday’s deadline for the Bank of England to stop supporting the market. Thankfully, it was relatively quiet, with the 30-year gilt yield

TMBMKGB-30Y,

back below 4.8%.

Earnings on the slate for Thursday include Delta

DAL,

Domino’s Pizza

DPZ,

Walgreens

WBA,

and BlackRock

BLK,

The Jan 6 Committee is back and will be looking at former President Donald Trump’s state of mind.

Taiwan Semiconductor Manufacturing

TSM,

the world’s biggest contract chip maker, reported forecast-beating results but warned of weakening demand as consumers spend less on tech.

The OPEC+ supply cut threatens to tip the global economy into recession warns the IEA. Saudi Arabia complained that it’s not fair to criticize it for siding with Russia in wanting to keep oil prices at nearly double the long-term average.

Best of the web

Does Finland have the answer to fake news?

U.S. suppliers halt operations at top Chinese memory chip maker.

The stocks most vulnerable to a strong dollar this earnings season.

The chart

Apes are an endangered species. Their cheap funding habitat has been destroyed by the Fed’s monetary logging, so to speak. AMC shares

AMC,

have collapsed to pre-meme stock levels. “Retail investors, having deployed record leverage to bolster their ‘buy the dip’ campaign from the pandemic lows, are in full retreat – anecdotally turning short sellers as the bear market grinds on,” says Julian Emanuel, strategist at Evercore ISI.

Source: Evercore ISI

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

AMC, |

AMC Entertainment |

|

NIO, |

NIO |

|

TSM, |

Taiwan Semiconductor Manufacturing ADR |

|

BBBY, |

Bed Bath & Beyond |

|

AAPL, |

Apple |

|

APE, |

AMC Entertainment preferred |

|

MMAT, |

Meta Minerals |

|

AMZN, |

Amazon.com |

Random reads

Supreme Leader goes casual. Think a badly-styled Tom Wolfe, with nukes.

Daquiri the dog wins pro-wrestling match.

Elon Musk has a new, well, musk.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.