Nhac Nguyen/Agence France-Presse/Getty Images

Caution: The stock market’s explosive rise in the past two days doesn’t necessarily mean the bear market is over.

If anything, the rally suggests that the bear market is alive and well.

How so?

It’s because daily spikes happen more frequently during bear than bull markets. So if you had to bet on the market’s major trend while knowing nothing more than the fact of the Dow Jones Industrial Average’s

DJIA,

700-plus-point increases in each of Monday and Tuesday’s trading sessions, your bet would have to be that the trend remains down.

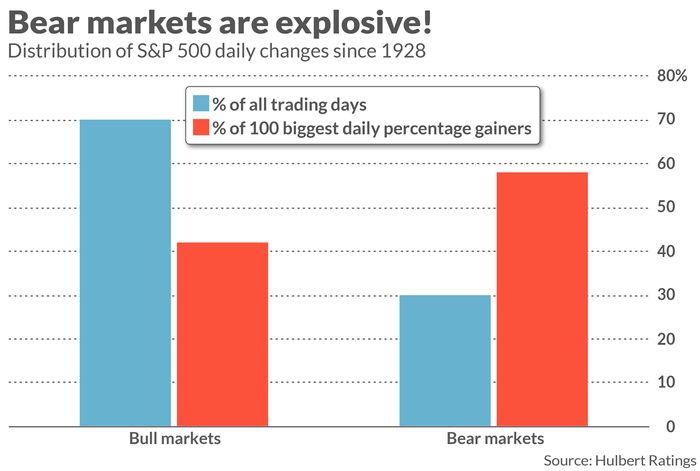

Consider what I found upon analyzing the distribution of the 100 biggest daily percentage S&P 500

SPX,

gains since 1928. You’d be excused for thinking that such big trading days occur randomly, since daily market gyrations are often considered to be little more than statistical noise.

But if they did occur randomly, you’d expect that, statistically, only 30 of those 100 increases would have taken place during bear markets.

In fact, 58% have occurred during bear markets. That’s nearly twice what you’d expect if such gains occurred randomly, as you can see from the accompanying chart, below.

‘Perfect examples’

This bear-market concentration of big daily gains is even more pronounced for the Nasdaq Composite Index

COMP,

according to a report from Cornell Capital.

The firm focused on the last three Nasdaq bear markets prior to this year: These are the bear markets that occurred from 2000 to 2002, 2007 to 2009, and from February to March 2020. Just 8% of the trading days since the Nasdaq Composite Index was created in 1971 have occurred during these three bear markets.

Nevertheless, according to Cornell Capital’s analysis, 80% of the 40 biggest one-day rallies in the Nasdaq Composite occurred during one of those three bear markets. That’s 10 times what you’d expect on the assumption that rallies occur randomly.

The implications of this Cornell Capital report for today’s market are disturbing. In an email, Bradford Cornell, an emeritus finance professor at UCLA and a senior adviser to the firm, told me that the rallies on Monday and Tuesday of this week are “perfect examples” of what he wrote about in that report.

The rally “does not necessarily mean that the bad times are over,” he said.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at [email protected].