While the contours of the Great Recession and the COVID Recession differed sharply, older workers continued to retire and claim Social Security.

The question that my co-authors, Anqi Chen and Siyan Liu, and I explored in a recent study is the relative impacts of the two recessions on the claiming behavior of different groups. To answer that question, we used data from the Health and Retirement Study to compare how the claiming pattern changed in the recession years 2008-2010 from the expansion years 2004-2006 with how the pattern changed in the recession year 2020 from the expansion years 2016-2018.

The unique nature of the COVID Recession suggests three hypotheses:

- The effects of poor health on early claiming would be stronger during the COVID Recession than during the Great Recession.

- The booming stock and housing markets during the COVID Recession would enable wealthier workers to claim early.

- Lower earners who benefited the most from the unprecedented expansion of unemployment insurance (UI) would be less likely to claim early in the COVID Recession than in the Great Recession.

The direct results of estimating two hazard models are almost impossible to interpret, so the study focused on the relative likelihood of early claiming for different groups.

Health: The results do not provide any support for the hypothesis of stronger health effects on early claiming during the COVID Recession than during the Great Recession. Two explanations are possible. First, reporting poor health is likely correlated with other variables in the equation such as education, wealth, and income, and therefore has no independent effect. Alternatively, because COVID allowed people to work from home, those in poor health may not have needed to exit the labor force.

Wealth: In the case of wealth, the hypothesis that the booming stock and housing markets during the COVID Recession would enable wealthier workers to claim early appears to hold. Specifically, before and during the Great Recession and in the pre-COVID boom, workers who had a defined-contribution (DC) retirement plan were less likely to claim early than workers without a plan. During the COVID Recession, as the stock market recovered, those with a DC plan were no longer less likely to claim early than those without a plan.

Unemployment Insurance: While increased UI benefits did not disproportionately affect early claiming for low and middle earners during the Great Recession, the COVID story was quite different. Before the COVID Recession, workers in the lower terciles were much more likely than those in the highest tercile to claim early; once the expanded payments became available, the claiming behavior of the earners in the lower terciles was not statistically different from those in the top tercile.

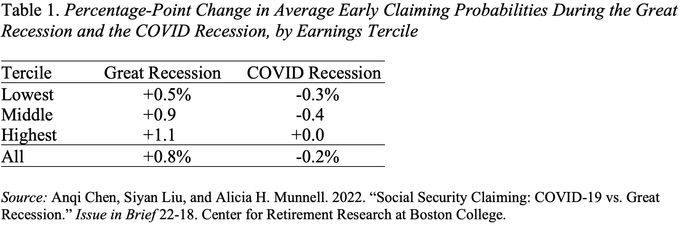

Overall Effects: Although the discussion above focuses on changes in relative likelihoods, the hazard model makes it possible to trace out the full claiming trajectory of older workers to calculate actual changes in the probabilities of claiming early. High unemployment rates during the Great Recession led to a 0.8-percentage-point increase in early claiming, while the COVID Recession led to a slight decline (see Table 1 above). The decline was led by low and middle earners responding to the high UI replacement rates. Thus, the expanded UI benefits not only helped workers in their immediate situation but also assured them slightly higher monthly Social Security benefits throughout retirement.