It’s taking more time for homeowners to sell their homes. And that’s potentially good news for homebuyers, who now have more room to negotiate.

Mortgage rates are soaring, with the 30-year fixed-rate averaging at 7.37% as of Thursday, according to Mortgage News Daily.

For the average homebuyer, the monthly payment on that mortgage has risen by 50% from a year earlier when mortgage rates were at 3%, Redfin said.

The massive jump in rates has iced buyer demand, with sales of existing-homes falling for the eighth month in a row. The last time sales dropped for so many consecutive months was in 2007.

So it makes sense that for-sale listings aren’t moving as fast as they did during the pandemic.

Listings currently take eight more days to go from for-sale to pending, as compared to last year, Zillow Z said in a report published Wednesday. The longer these homes spend on the market, the more “inspiring” it is for sellers to cut prices to attract more buyers, Zillow said.

To that end, 27.5% of listings in September had price cuts, Zillow added. Before the pandemic, only around 22% of listings had price cuts.

“A less stressful experience for homebuyers is a silver lining of today’s market,” Jeff Tucker, senior economist at Zillow, told MarketWatch.

“For those who can afford it, conditions have become much more buyer-friendly than last year. Less competition means home shoppers now have more time to consider their options to make sure they find the best fit, less chance of getting caught up in a bidding war and they may even be able to get a discount on list price,” he added.

“Homes are taking twice as long to sell as they did in the spring,” a report by Redfin

RDFN,

said.

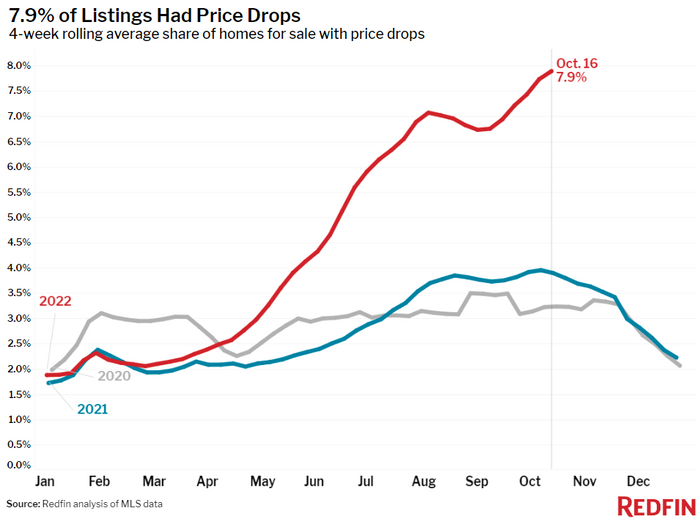

Sellers are dropping their prices to entice buyers, as seen in the chart below.

“On average, a record high 7.9% of homes for sale each week had a price drop, up from 3.9% a year earlier,” Redfin said.

Graphic: Redfin

“Homes will eventually sell, but it may take a few months, and sellers need to meet buyers where they are,” Chen Zhao of Redfin said.

“That means lower prices and negotiations, including things like giving buyers a credit to buy down their mortgage rate and paying for home repairs,” Zhao added.

For-sale homes were on the market for 34 days, a full week longer than the time homes spent on the market a year ago, Redfin said. It’s also a big change from May this year, when homes were sold in 17 days on average.

As of mid-October, about 8% of homes for sale had a price drop to lure buyers, which is up from 4% a year ago, Redfin added.

The increase in time on the market tracks with other real-estate companies’ analyses.

Realtor.com also said that homes spent one whole extra week on the market in October.

“For homeowners contemplating a sale, this means planning for extra time in the process,” the report stated. “For buyers, it may mean a bit more time to think through options.”

(Realtor.com is operated by News Corp subsidiary Move Inc., and MarketWatch is a unit of Dow Jones, which is also a subsidiary of News Corp.)

Existing homes on sale stayed on the market for 19 days in September, a tad longer than the 16 days reported in August, the National Association of Realtors said on Thursday.

Buyers’ angst over rates has resulted in home sellers seeing their profits shrink, a report from ATTOM said.

Profit margins on median-priced single-family home and condo sales across the U.S. fell by 54.6% as home prices declined for the first time in 3 years, according to a report by the company.

“Rapidly-rising mortgage rates have not only resulted in fewer home sales, but have begun to impact home prices as well,” Rick Sharga, executive vice president of market intelligence at ATTOM, said in a statement.

The median price of a home fell by around 3% from the second quarter, to roughly $340,000, the company said.

The biggest drop in profits was seen in cities including Claremont-Lebanon, N.H., San Francisco, Prescott, Ariz., and Barnstable, Mass.

And with mortgage rates poised to go higher, it is “very likely that home prices will continue to weaken in many markets in the coming months,” Sharga said.

“If the Federal Reserve’s objective was to slow down the housing market, it has succeeded spectacularly,” he added.

An ‘open house’ at a single family home in Los Angeles in September. It’s taking longer for homeowners to sell their homes, which is giving buyers more breathing room to negotiate on price.

(Photo by Allison Dinner/Getty Images)

The other gauge to track closely is inventory — or in real-estate speak, months supply.

That number tells us how many months it would take for the current inventory of homes on the market to sell given the current pace, NAR said.

In September, for-sale homes spent about 3.2 months on the market, which while still short of the usual four or five months homes spent on the market pre-pandemic, is still a significant difference from the last two years.

In January 2022, for-sale listings spent a record low of 1.6 months on the market, according to data from the NAR.

To be clear, even if it’s currently rising, housing inventory overall still remains low, Ian Shepherdson, chief economist at Pantheon Macroeconomics wrote in a note.

People are sitting on their homes, either wanting to hold on to their record-low mortgage rate, or for fear of not being able to sell at a price they want. Sellers are “on strike,” as one housing blogger put it.

Roughly 86% of people with mortgages have rates below 5%, and 24% below 3%, according to data on outstanding residential mortgages from the Federal Housing Finance Authority data. The data is as of June 30, 2022.

New for-sale listings fell 15% in September compared to a year ago, Realtor.com estimates. Redfin estimates that listings fell 22% in September compared to the previous month, and by 25% from a year ago. Zillow said listings in September fell 16% from a year ago.

And the fewer the listings, the harder it will be for prices to come down.

But for the market to fully rebalance, prices have to fall “substantially,” Shepherdson said. He’s expecting home prices to drop 15% to 20% over the next year.

Got thoughts on the housing market? Write to MarketWatch reporter Aarthi Swaminathan at [email protected]