Deutsche Bank, which became the first major Wall Street bank to forecast a U.S. recession in April, is running through its list of pros and cons for why the world’s largest economy might achieve a soft landing — and coming to the conclusion that it won’t.

“Our view is that the pessimists will sadly prevail on this occasion,” Henry Allen, a Deutsche Bank research analyst, wrote in a note released soon after Tuesday’s release of the August consumer-price index, which showed inflation spreading more broadly despite falling gasoline prices. One of the biggest reasons is that the full impact of the Federal Reserve’s string of interest rate hikes won’t be felt for a year, or until 2023, Allen said.

Financial markets reeled after the August CPI data, which contained signs of inflation spreading further into services and came in higher than both economists and traders had expected, at an annual headline rate of 8.3%. The Dow industrials

DJIA,

finished down by almost 1,300 points, falling alongside the S&P 500

SPX,

and the Nasdaq Composite

COMP,

in what was the worst day for stocks since June 2020. Meanwhile, investors sold off most Treasurys, sending the policy-sensitive 2-year yield

TMUBMUSD02Y,

to another 2007 high, and traders boosted their expectations for a jumbo-size, 100-basis-point Fed rate hike next week.

“Stubborn inflation pressures are likely to force the Fed to turn up the heat on its tightening campaign, which puts the broader economy at further risk of a material downturn/recession within the next year,” said Jason Pride, chief investment officer of private wealth at Glenmede, which manages $40.2 billion in assets. “In recognition of these uncertainties, investors should maintain an underweight risk posture, particularly given the premium valuations still prevalent in equity markets,” Pride wrote in a note.

In April, Deutsche Bank

DB,

based in Frankfurt, Germany, became the first major Wall Street bank to predict a U.S. recession, citing inflation psychology that had shifted significantly and long-term expectations that were at risk of coming unanchored. It continued to see downside risks to its own pessimistic outlook that month, and has called itself “the extreme outlier on the street.” In June, Deutsche Bank also said it saw a chance that inflation would fail to decelerate.

Here is Deutsche Bank’s list of reasons for why a hard landing is still ahead for the U.S. economy, despite hopes that supply chains and the labor market are beginning to normalize.

Monetary policy lags

Fed rate hikes operate with a lag of roughly a year, meaning that the bulk of the central bank’s rate-hike campaign still hasn’t worked its way through the U.S. economy yet.

To be sure, interest-rate-sensitive sectors like housing are already feeling the effects of Fed rate hikes, with the National Association of Home Builders’ market index plummeting in recent months, and an index of pending sales near one of its lowest levels in more than a decade, Allen wrote. But those effects are expected to become more prominent over the months to come.

Fed officials are still mostly expected to lift their main policy rate target again next week by 75 basis points to between 3% and 3.25%, from a current level of 2.25% and 2.5%. However, traders are also now factoring in a 34% chance of a full-percentage-point hike on Sept. 21, that would lift the fed funds rate to between 3.25% and 3.5%, up from a zero chance seen on Monday, according to the CME FedWatch Tool.

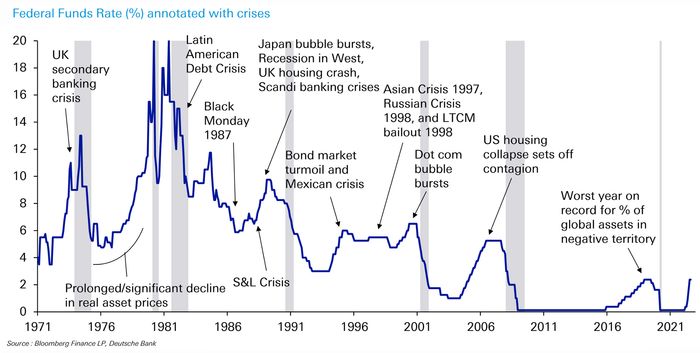

The chart below shows how Fed tightening cycles have coincided with major crisis somewhere in the world.

Source: Bloomberg, Deutsche Bank

Tight labor market

The tight U.S. labor market has often been cited by optimists as the biggest reason that the world’s largest economy can avoid a downturn, given the widespread availability of jobs and continued demand for workers. However, Deutsche Bank’s Allen said the “incredibly” tight labor market will make it harder to curb inflation and could even “necessitate more rate hikes.”

The number of vacancies per unemployed worker is just shy of the record reached in March, and broad-based labor-force participation beyond just prime-age workers remains a full percentage point beneath its pre-Covid levels, the research analyst said.

“There is also no precedent for managing to cool down the labour market by only reducing vacancies without a rise in unemployment,” he wrote.

Recession indicators are ‘flashing red’

The spread between the 2- and 10-year Treasury yields

TMUBMUSD10Y,

long seen as a reliable harbinger of a recession, first inverted this year in March and remains deeply negative, at minus 33 basis points on Tuesday after the CPI report.

That part of the curve has inverted prior to each one of the last 10 U.S. recessions and, based on historical averages of how long it takes for a downturn to materialize, a recession could arrive by the second half of next year, Allen said.

Inflation outliers

Recent declines in inflation, which gave some hope that elevated price gains might be turning a corner, were driven by what Allen calls “outliers” rather than broad-based moves. That was the case for the August and July CPI, which both reflected lower energy prices. Energy prices tend to be volatile anyway and are often excluded by policy makers when they try to determine where inflation could go from here.

Conclusions

Based on how far the Fed has deviated from both its price-stability and maximum employment mandates over time, no soft landing has ever been achieved, according to Deutsche Bank.

“We very much hope we are wrong here, but given the difficulties the economy is set to encounter into 2023 as the lagged effects of rate hikes kick in, a soft landing will be very challenging to avoid,” Allen said. “In particular, the empirical evidence shows that the sort of soft landing people are hoping for has never happened before from a position like the present one with inflation well above target and a very tight labour market.”