The U.S. dollar keeps getting compared with a “wrecking ball” in regard to the economic and market havoc caused by its outsize 2022 rally.

But there’s only so much central bankers and other economic policy makers can do, warned Paul F. Gruenwald, global chief economist at S&P Global, in a Thursday note. To address the factors really driving the dollar’s rally will require politicians do the heavy lifting, he argued.

See: Why an epic U.S. dollar rally could be a ‘wrecking ball’ for financial markets

So how strong is the dollar? The ICE U.S. Dollar Index

DXY,

a measure of the currency against a basket of six major rivals, hit a 20-year high shy of 115 last month before pulling back in early October. It remains up more than 17% for the year to date and nearly 20% over the last 12 months.

The British pound

GBPUSD,

fell last week to an all-time low versus the U.S. dollar as the U.K. became engulfed in a fiscal crisis. The euro

EURUSD,

has dropped below parity versus the dollar, with the eurozone expected to suffer a brutal winter downturn as a result of the energy shock created by Russia’s invasion of Ukraine. The Japanese yen recently traded at its lowest versus the U.S. dollar versus 1998, prompting a rare round of intervention by the Bank of Japan.

See: Don’t look for a stock market bottom until a soaring dollar cools down. Here’s why.

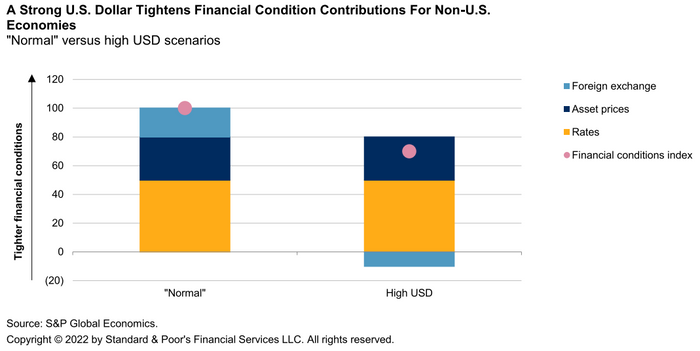

Why is a strong dollar a problem? While a stronger dollar helps keep a lid on inflation in the U.S., the depreciation of rival currencies amplifies inflation in those economies. The scope and speed of the dollar’s rally has stirred fears of market dislocations and stresses in emerging and developing economies that carry a high proportion of dollar-denominated debt. The dollar’s gains are also viewed as a negative for U.S. large-cap multinationals who rely on international sales.

S&P Global Economics

Read below what Gruenwald had to say about the four options available to countries and economies struggling to fend off a strong dollar — and why none of them are ideal:

Ride out the storm. This is not really an option. Episodes of outsized dollar strength can last for years. Letting an exchange rate depreciate will lead to higher inflation, higher debt servicing costs, lower disposable income and reduced policy maker credibility. Moreover, it is likely to have domestic political economy costs as policy makers are seen as needing to “do something”.

Lean against the wind by using reserves. This is not likely to be a winning strategy either. Intervention can slow the rate of depreciation, but if the pressures are large and sustained these victories will be fleeting. Markets can and will test policy makers, and the result is likely to be a weaker currency and fewer reserves. Reserves are normally used to smooth market volatility in times of turbulence, but not for fighting ongoing waves of depreciation pressures.

Impose capital controls. Restricting access to foreign exchange is a tempting but likely ineffective approach. The probable outcome is a black market and dual or multiple exchange rates, with only “insiders” getting access to access foreign currency. This will lead to market distortion and dislocation. It will also create reputational damage and limit the future use of the currency for international transactions.

Raise interest rates to offset the deprecation. This is the textbook response to loosening financial conditions. However, this is also problematic. If monetary policy makers are “doing the right thing” in terms of raising rates to tighten financial conditions and lower inflation to ensure sustainable growth, then unwanted currency depreciation means rates must go higher. This is a consequence of the well-known Mundell trilemma. In essence, this means higher rates and lower output and employment as a result of importing someone else’s inflation. [The Mundell trilemma is the concept that a country can’t maintain a flexible monetary policy, a fixed exchange rate, and free capital flows at the same time — it must choose two of the three.]

There are also “global options,” the economist notes. These include dollar swap lines with other countries, such as those that were expanded or initiated in early 2020 as a global scramble for U.S. currency sent the greenback soaring as the COVID-19 pandemic slammed the global economy. While swap lines have proved effective in such situations, it isn’t clear they would be appropriate for soaring dollar valuations, Gruenwald wrote, “because they are akin to extra reserves: they are likely to be depleted in defending an exchange rate level.”

And then there’s the big one. A Plaza Accord-style agreement between major economies. The 1985 Plaza Accord saw the Federal Reserve and the central banks of Germany, the U.K., France and Japan agreed to intervene to bring down the value of the U.S. dollar, which, as Gruenwald described, had seen the “mother of all…appreciations.”

Related: Why a soaring dollar is raising questions — and doubts — about a Plaza Accord-style intervention

But even though the current pain of dollar strength is becoming evident and on the rise, DXY is still three to four standard deviations away from its peak in 1985, he said, noting that the focus then was on trade imbalances and that China wasn’t part of the discussion given its small economy at that time.

At some point, the pain may become too much to bear.

“Ultimately, resolution will depend not just on economics but also politics,” Gruenwald wrote.

Dollar strength “becomes excessive when it starts to negatively impact other economies more than it benefits the U.S. The exact measurement of this is difficult,

but one way to gauge it is to ask: What would a global, benevolent policy maker prescribe?” he wrote.

At some point a strong dollar becomes less than optimal for all involved, “and if markets do not correct, the solution will have a political element,” Gruenwald wrote.

The extreme — and persistently — high U.S. dollar of the 1980s was in the end brought downthrough the Plaza Accord, he noted. “The actors may be different this time around, but the endgame might end up looking the same.”